Affordable Homes in Australia in 2025

Understanding the Affordable Housing Market in Australia

The Australian housing market has long been a topic of discussion, especially when it comes to affordability. With property prices soaring in major cities, many Australians are seeking affordable homes that do not compromise on quality or location. The government and private sectors have been working towards creating more affordable housing options, but the demand continues to outpace supply.

In recent years, various initiatives have been launched to make housing more accessible. These include shared equity schemes, government grants, and incentives for developers to include affordable units in their projects. However, navigating these options can be daunting for potential homeowners. Understanding the nuances of the market and available programs is crucial for those looking to buy or rent an affordable home.

Key factors influencing the affordable housing market include:

- Location: Proximity to public transport and essential services can significantly impact affordability.

- Size and Type: The size and type of dwelling, whether a unit, townhouse, or house, can affect pricing.

- Market Trends: Keeping an eye on market trends can help buyers and renters make informed decisions.

Overall, understanding these elements can help individuals and families make more informed decisions when exploring affordable housing options.

Buy or Rent: Making the Right Choice

Deciding whether to buy or rent a home is a significant decision that depends on various factors, including financial stability, lifestyle preferences, and long-term goals. In Australia, both options come with their own set of advantages and challenges, particularly within the affordable housing sector.

Buying a home offers a sense of stability and the potential for property value appreciation. Homeownership can also provide tax benefits and the freedom to make modifications to the property. However, it requires a substantial upfront investment, ongoing maintenance costs, and can be less flexible than renting.

Renting, on the other hand, offers flexibility and lower upfront costs. It allows individuals to live in desirable locations without the long-term commitment of a mortgage. Renting can be an attractive option for those who prioritize flexibility and do not want to be tied down by property ownership.

Ultimately, the decision between buying and renting should be based on personal circumstances, financial readiness, and long-term aspirations. Evaluating these factors can help individuals and families choose the path that aligns best with their needs and goals.

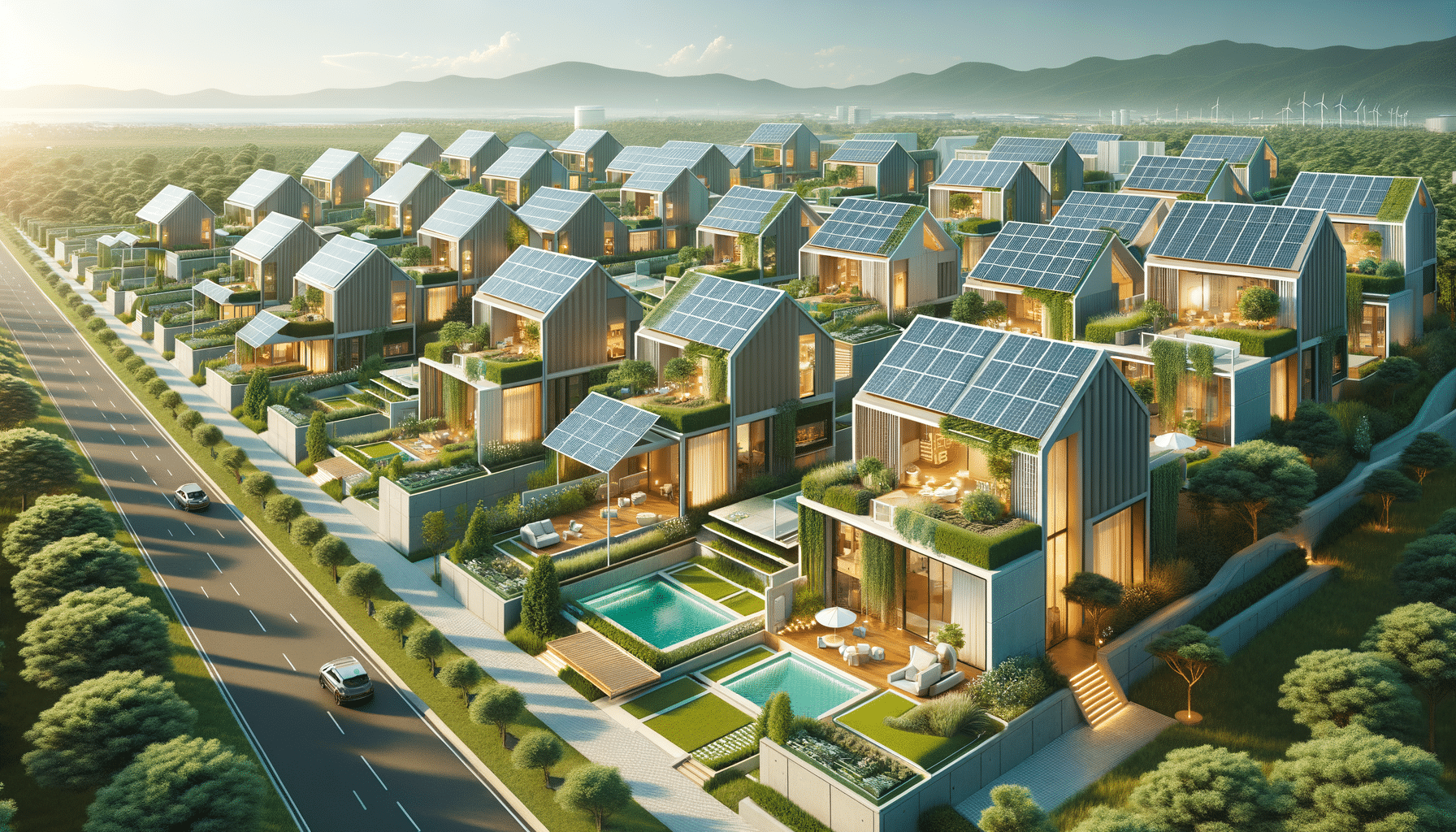

Modern Energy Efficient Homes at Affordable Rent

As sustainability becomes a priority for many Australians, the demand for modern, energy-efficient homes is on the rise. These homes not only contribute to environmental conservation but also offer long-term savings on utility bills. Fortunately, energy-efficient homes are becoming more accessible to renters, thanks to advancements in building technology and increased awareness.

Energy-efficient homes are designed to minimize energy consumption through features such as:

- Insulation: Proper insulation reduces the need for heating and cooling, leading to lower energy bills.

- Solar Panels: Harnessing solar energy can significantly cut electricity costs.

- Energy-efficient Appliances: Modern appliances consume less energy, contributing to overall savings.

For those seeking affordable rent, energy-efficient homes offer the dual benefit of cost savings and environmental responsibility. Many new developments in Australia are incorporating these features, making it easier for renters to find homes that align with their values and budget.

By choosing an energy-efficient home, renters can enjoy a comfortable living environment while reducing their carbon footprint and enjoying financial savings.

Exploring Government Initiatives for Affordable Housing

The Australian government has implemented several initiatives to address the issue of affordable housing. These programs aim to support low-to-moderate income individuals and families in accessing housing that meets their needs without financial strain.

Some key government initiatives include:

- First Home Owner Grant: This grant provides financial assistance to first-time homebuyers, making it easier to enter the property market.

- National Rental Affordability Scheme (NRAS): This scheme encourages the development of affordable rental properties through financial incentives to developers and investors.

- Shared Equity Schemes: These programs allow buyers to purchase a share of a property, reducing the initial cost and making homeownership more attainable.

These initiatives are designed to provide pathways to affordable housing, but understanding the eligibility criteria and application processes is essential. Prospective buyers and renters should research these programs to determine which ones align with their circumstances and goals.

Conclusion: Navigating the Path to Affordable Housing

Affordable housing in Australia is a multifaceted issue that requires careful consideration and planning. Whether choosing to buy or rent, understanding the market, exploring energy-efficient options, and leveraging government initiatives can significantly impact the accessibility of housing.

For individuals and families seeking affordable homes, it is crucial to stay informed about market trends and available programs. By doing so, they can make informed decisions that align with their financial situation and lifestyle preferences.

Ultimately, the journey to affordable housing is unique for each individual, but with the right knowledge and resources, it is possible to find a home that meets both financial and personal needs.