Unsold Abandoned Properties and How to Locate Them in Your Area

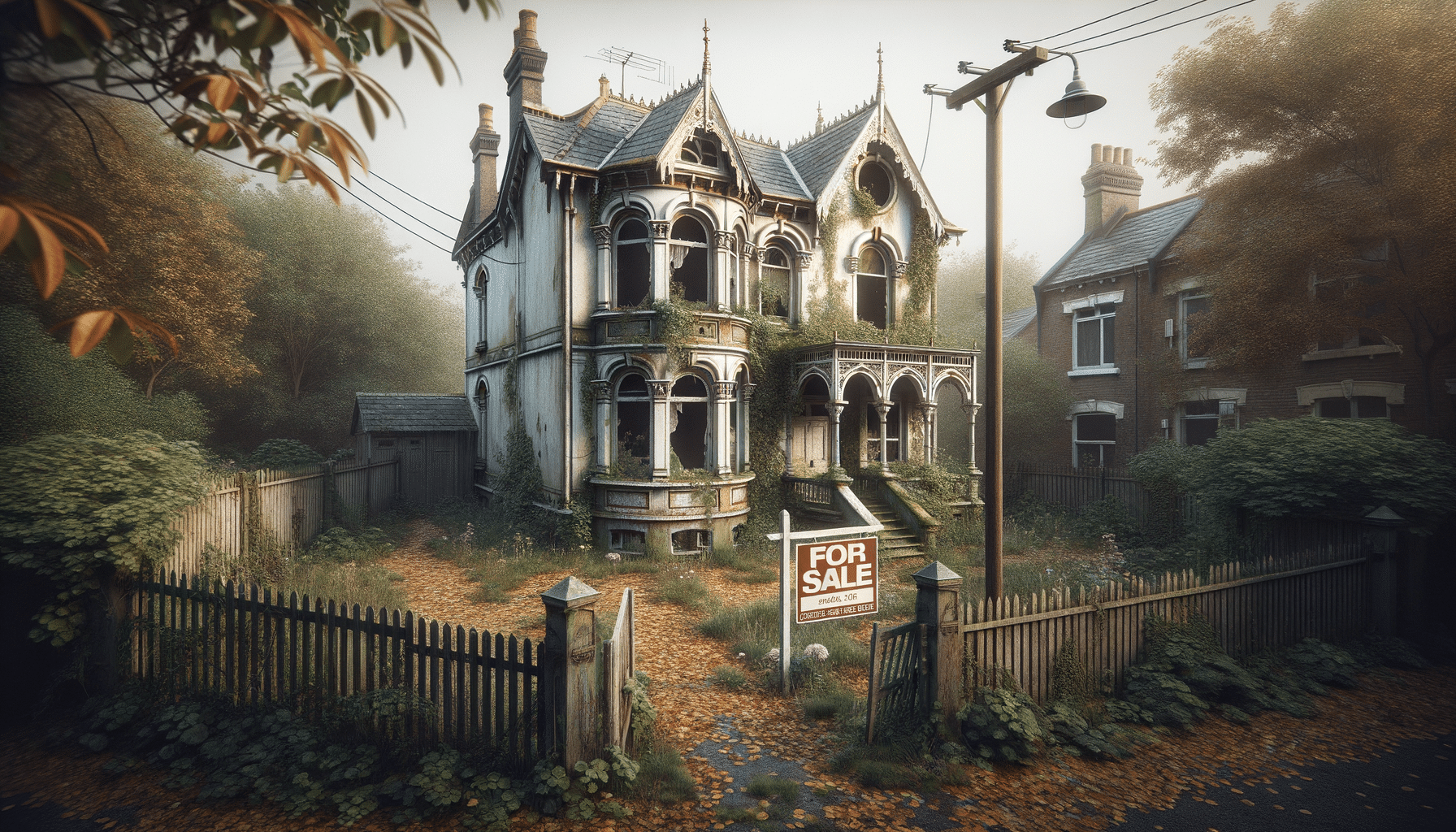

Introduction to Abandoned Homes for Sale

Abandoned homes for sale present a unique opportunity for investors and homebuyers alike. These properties, often left unattended due to various reasons, can be acquired at a fraction of the market price, making them attractive for those looking to renovate or invest in real estate. However, finding these properties can be challenging, as they are not always listed on traditional real estate platforms. Understanding the nuances of abandoned property sales can help potential buyers make informed decisions and potentially secure a lucrative deal.

Abandoned homes often come onto the market through auctions or are listed by banks when previous owners default on their mortgages. These properties might require significant renovation, but they offer the chance to customize a home to personal tastes or to increase its market value. By understanding the processes involved in acquiring these homes, buyers can navigate the complexities of such transactions and potentially benefit from a rewarding investment.

Navigating Property Auctions

Property auctions are a common method for selling abandoned homes, offering a transparent and competitive environment for potential buyers. Auctions can be conducted by local governments, banks, or private auction houses, each with its own set of rules and procedures. Understanding these can help buyers prepare effectively and increase their chances of success.

At an auction, properties are typically sold “as-is,” meaning buyers should conduct thorough research and inspections beforehand to understand the condition of the home. This research might include reviewing property records, assessing the neighborhood, and estimating renovation costs. Auctions can be fast-paced and competitive, so setting a budget and sticking to it is crucial to avoid overspending.

Some advantages of buying at auction include potentially lower prices and the opportunity to purchase properties that may not be available through traditional real estate channels. However, buyers must also be aware of the risks, such as hidden repair costs and the need for immediate payment upon winning a bid.

Exploring Bank-Owned Property Auctions

Bank-owned property auctions, also known as REO (Real Estate Owned) auctions, occur when a property fails to sell at a foreclosure auction and becomes the property of the bank. These auctions can be a valuable resource for buyers looking for discounted properties, as banks are often eager to offload these assets.

Bank-owned properties are generally sold at a lower price compared to market value, providing an opportunity for buyers to gain equity quickly. However, purchasing through these auctions requires careful consideration of the property’s condition and any liens or encumbrances that may exist. Buyers should conduct due diligence, including title searches and property inspections, to ensure there are no unforeseen issues.

One benefit of bank-owned auctions is that banks may be more willing to negotiate terms, such as financing options or repair credits, to facilitate a sale. This flexibility can make bank-owned properties an attractive option for buyers willing to invest time and effort into the purchasing process.

Strategies for Locating Abandoned Properties

Finding abandoned properties requires a strategic approach, as they are not always prominently advertised. Potential buyers can start by exploring local government records, which often list properties that are tax delinquent or in foreclosure. These records can provide valuable leads on properties that may soon be available for purchase.

Networking with real estate agents, attending local foreclosure auctions, and joining real estate investment groups are also effective ways to uncover opportunities. These channels can provide insights into the local market and introduce buyers to properties before they are widely advertised.

Online platforms and databases dedicated to foreclosure listings can also be useful tools for identifying abandoned properties. These resources often allow users to search by location, price range, and property type, making it easier to find properties that meet specific criteria.

Conclusion: Opportunities and Considerations

Investing in abandoned homes can be a rewarding venture, offering the potential for significant financial returns. However, it requires careful research, strategic planning, and a willingness to take on the challenges of renovation and property management. By understanding the processes involved in property auctions and bank-owned sales, buyers can navigate the market more effectively and increase their chances of success.

Ultimately, the key to success in this niche market is due diligence. Buyers should thoroughly research each property, understand the legal and financial implications, and be prepared to act quickly when opportunities arise. With the right approach, abandoned homes can transform from neglected spaces into valuable assets.